43 coupon value of a bond

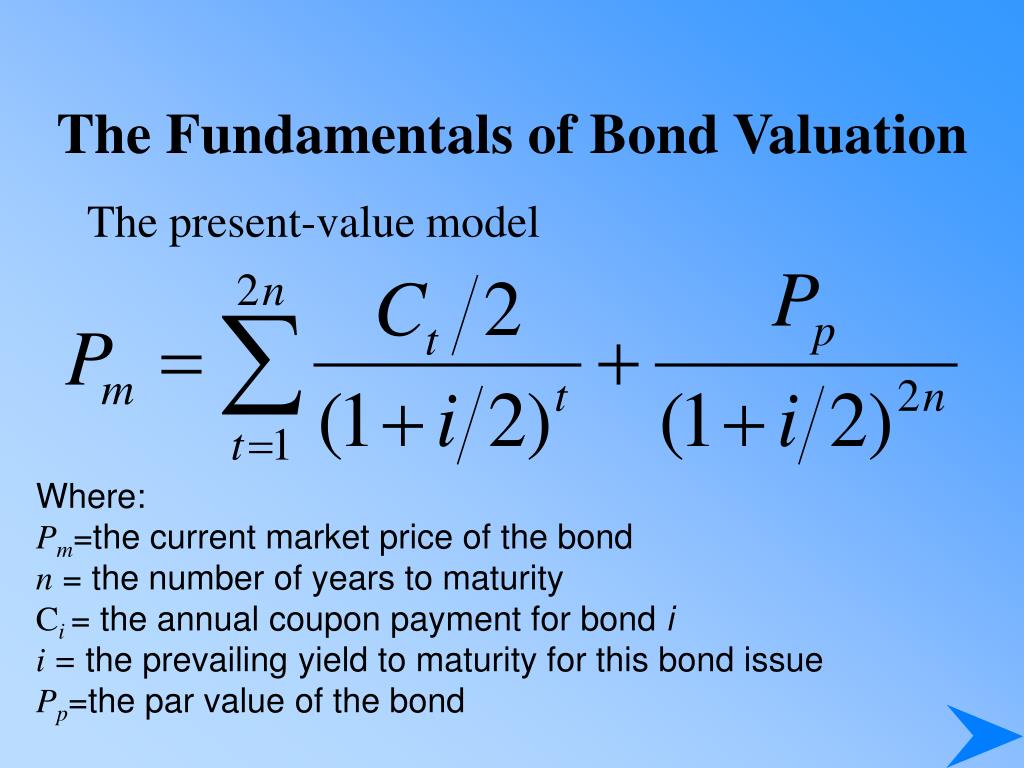

Bond Valuation: Formula, Steps & Examples - Study.com A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,... Coupon Bond Formula | Examples with Excel Template Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

Coupon Bond Formula | How to Calculate the Price of Coupon ... Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers.

Coupon value of a bond

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84 Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Coupon value of a bond. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... Magnit announces payment of the coupon yield and the ... Please be informed that PJSC Magnit fulfilled its obligation of the 5th coupon yield payment (02.11.2021 03.05.2022) against bonds in the amount of 344,100,000 rubles and the nominal value of... dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future ... - DQYDJ Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Coupon Rate Formula | Step by Step Calculation (with Examples) Do the Calculation of the coupon rate of the bond. Annual Coupon Payment Annual coupon payment = 2 * Half-yearly coupon payment = 2 * $25 = $50 Therefore, the calculation of the coupon rate of the bond is as follows - Coupon Rate of the Bond will be - Example #2 Let us take another example of bond security with unequal periodic coupon payments.

› terms › pPar Value Definition Feb 28, 2022 · Par: Short for "par value," par can refer to bonds , preferred stock , common stock or currencies , with different meanings depending on the context. Par most commonly refers to bonds, in which ... Answered: 1. A coupon bond with a $4 million face… | bartleby Solution for 1. A coupon bond with a $4 million face value which makes a coupon payment of $100,000 has a coupon rate of a. 4 per cent b. 40 per cent c. 2.5 per… Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. What Is the Face Value of a Bond? - SmartAsset A bond's coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond's face value on its maturity date.

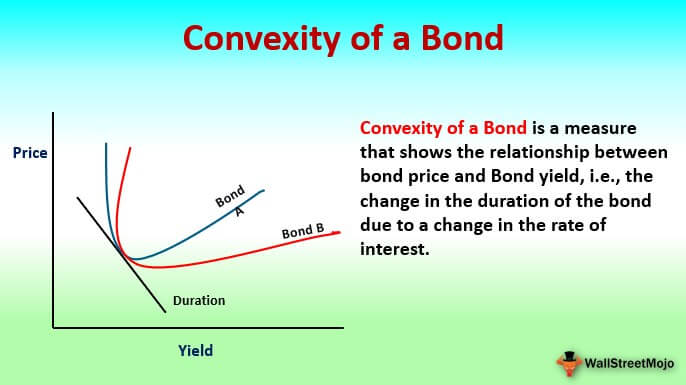

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ... Bond Value Calculator: What It Should Be Trading At ... Bond valuation is a method used to determine the expected trading price of a bond. The expected trading price is calculated by adding the sum of the present values of all coupon payments to the present value of the par value (no worries, the bond value calculator performs all of the calculations for you, and shows its work). › Zero-Coupon-BondZero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ... Bond Valuation Calculator | Calculate Bond Valuation Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. To use our free Bond Valuation Calculator just enter in the bond face value, months until the bonds maturity date, the bond coupon rate percentage, the current market rate percentage (discount rate), and then press the calculate button. That's it!

Bond Formula | How to Calculate a Bond | Examples with ... The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. Solution: Bond Price is calculated using the formula given below Bond Price = C * [ (1 - (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t]

What Is a Bond Coupon? - The Balance How Bond Coupons Work Today . Technology has changed the process of investing in a bond. The need for paper coupons is no more. But the term is still used. A bond's coupon refers to the amount of interest due and when it will be paid. A $100,000 bond with a 5% coupon pays 5% interest.

Calculation of the Value of Bonds (With Formula) Find present value of the bond when par value or face value is Rs. 100, coupon rate is 15%, current market price is Rs. 90/-. The bond has a six year maturity value and has a premium of 10%. If the required rate of returns is 17% the value of the bond will be: = Rs 15 (PVAF 17%6 Years )+110 (PVDF 17% 6 years ), = Rs. 15 x (3.589) +110 (.390)

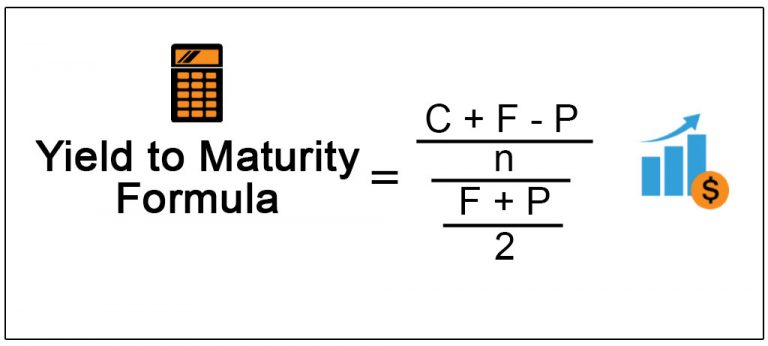

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM, the bond price is less than the face value, and as such, the bond is said to be traded at a discount. Example #2. Let us take an example of a bond with semi-annual coupon payments.

Bond Valuation Overview (With Formulas and Examples) The coupon rate is set at 3%, and the bond sold at a par value of $1000 with a maturity of two years. So looking at the same rates as AMD for the discount rate, which is 7%. Because the coupon is 3%, our annual coupon payment is $30, and then our semi-annual payment is $15.

What Is a Coupon Bond? - investopedia.com Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This means...

Zero-Coupon Bond: Formula and Excel Calculator To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Post a Comment for "43 coupon value of a bond"