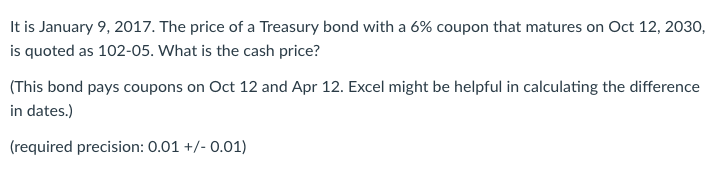

43 us treasury bonds coupon rate

U.S. Treasury Bond Futures Quotes - CME Group CME TreasuryWatch Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. Total Cost Analysis Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

Treasury goes for Sh60 billion in extended bonds sale The pair of bonds, which will be on sale until July 19, have coupon rates of 12 and 12.75 per cent respectively In Summary The first prospectus on the tap sale covers Sh20 billion

Us treasury bonds coupon rate

Individual - Series I Savings Bonds - TreasuryDirect Rates & Terms. I bonds have an annual interest rate derived from a fixed rate and a semiannual inflation rate. Interest, if any, is added to the bond monthly and is paid when you cash the bond. I bonds are sold at face value; i.e., you pay $50 for a $50 bond. More about I bond rates; Redemption Information. Minimum term of ownership: 1 year How Is the Interest Rate on a Treasury Bond Determined? If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the... Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis.

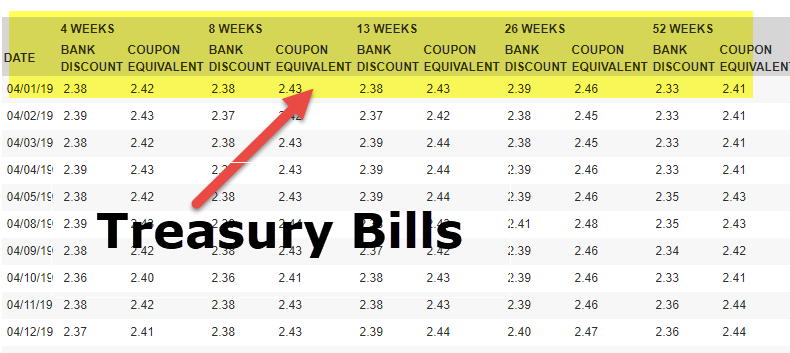

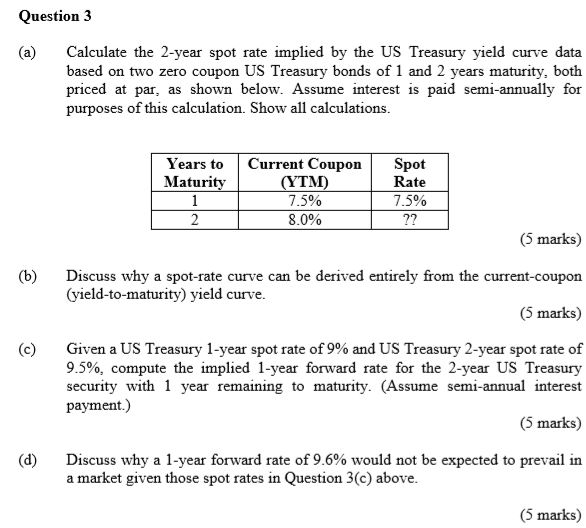

Us treasury bonds coupon rate. Rates & Bonds Market Headlines | Reuters US 10 Year Treasury Yield. US10YT=XX +3.202 +0.008: trading higher. UK 10 Year Yield. GB10YT=RR +2.387-0.008: ... Rates & Bonds Japan says hard to confirm impact from Russia's debt default, ... A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon . Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity. U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an... Important Differences Between Coupon and Yield to Maturity For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued.

US Treasury Bonds Rates - Yahoo Finance US Treasury Bonds Rates. Symbol. Name Last Price Change % Change 52 Week Range Day Chart ^IRX. 13 Week Treasury Bill: 1.7380 +0.1050 +6.43% ^FVX. Treasury Yield 5 Years: 3.2600 +0.0020 +0.06% ^TNX. Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond... Solved 1. A US Treasury bond has a coupon rate of 5.95%, - Chegg Finance. Finance questions and answers. 1. A US Treasury bond has a coupon rate of 5.95%, semi-annual coupon payments, face value of $1,000, and 22 years to maturity. If current market yields on similar bonds is 4.7%, what is the price of this bond? 2. A zero-coupon bond has a current yield of 8%, a face value of $1,000, and 23 years to maturity. US Treasury Series I Savings Bonds Inflation Rate Earnings (May ... 564,807 Views 1,245 Comments. U.S. Government Treasury is currently offering 9.62% Interest Rate (Annualized for 6 Months) in combined Fixed + Inflation Rate Earnings valid on newly issued Series I Savings Bonds purchased from May through October 2022. Limit of $10,000/year per person. Thanks to Community Member Libertarian for posting this offer.

Savings Bonds Search for Matured Bonds (Treasury Hunt) Securities we sell; Cash paper savings bond; Interest rates for Series EE ... You can call us from 8 a.m. to 5 p.m. ET, Monday through Friday. ... Series I Bond FAQs; The annual purchase limit for Series I savings bonds in TreasuryDirect® is $10,000. Purchases exceeding the annual limit will be refunded ... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

Are most US treasury bonds which pay coupons of fixed interest rates? Answer (1 of 5): Yes, most conventional Treasury bonds are issued with a coupon that is fixed for the life of the bond. For example, a 3% coupon bond will pay $15 in interest every 6 months—$30 per year on a bond with $1000 face value— no matter what. But there are exceptions: * Bonds that ma...

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Treasury Inflation-Protected Securities: FAQs about TIPS The coupon rate won't change but the coupon payment will. TIPS have fixed coupon rates, which are based on the principal value of the security. ... US Treasury Inflation Indexed Curve (YCGT0169). ... or through a mutual fund or ETF. There are pros and cons to each approach. By holding individual bonds, you can plan to hold to maturity, meaning ...

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Treasury Coupon Issues | U.S. Department of the Treasury The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). ... TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977 TNC Treasury Yield Curve Spot ...

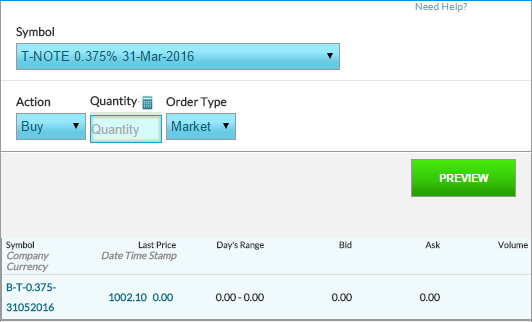

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.983% yield. 10 Years vs 2 Years bond spread is 4.2 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in June 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

United States Government Bond 10Y - 2022 Data - 1912-2021 Historical ... United States Government Bond 10Y The yield on the US Treasury 10-year note fell below 3.10% on Wednesday, down more than 10 basis points from the previous session, amid concerns over a looming recession and that the Fed will tip the economy into a recession as it focuses more on inflationary risks.

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis.

How Is the Interest Rate on a Treasury Bond Determined? If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the...

Individual - Series I Savings Bonds - TreasuryDirect Rates & Terms. I bonds have an annual interest rate derived from a fixed rate and a semiannual inflation rate. Interest, if any, is added to the bond monthly and is paid when you cash the bond. I bonds are sold at face value; i.e., you pay $50 for a $50 bond. More about I bond rates; Redemption Information. Minimum term of ownership: 1 year

Post a Comment for "43 us treasury bonds coupon rate"