40 coupon rate and yield

Bonds - MunicipalBonds.com New York Yield Curve. Maturity Year Number of Trades Average Yield Dollar Volume; 2022: 23: 1.693: $6,878,540+ 2023: 110: 1.991: $28,150,000+ 2024: 84: 1.951: $5,540,000 ... Default Rates of Municipal Bonds; Taxable-Equivalent Yield; Tax-Exemption from State Income Taxes; How to Look at a Bond for Sale; Daily Treasury Yield Curve Rates - YCharts Canadian Overnight Repo Rate Average: Aug 11 2022, 10:00 EDT: H.15 Selected Interest Rates: Aug 11 2022, 16:15 EDT: Euro Yield Curves: Aug 11 2022, 17:00 EDT: Daily Treasury Yield Curve Rates: Aug 11 2022, 18:00 EDT: Japan Government Bonds Interest Rates: Aug 11 2022, 19:30 EDT: Bank of Japan Basic Discount Rate: Aug 11 2022, 19:50 EDT: Euro ...

Looking For Relative Value In 7-8%-Yielding AGNC And NLY Preferreds Two of the preferreds will switch to Libor-based floating-rate coupons this year, one will switch in 2023 and the rest in 2024/2025. ... LT Reset Yield is helpful because it provides an apples-to ...

Coupon rate and yield

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Tax yield investment explained with examples The yield must be higher than its tax equivalent yield. If the investor's required rate of return is 25 percent and the tax-equivalent yield is 28 percent. Then it is not a tax yield Investment. Read: ... For example, the income from a bond is the coupon rate attached to the bond. If the rate is 10 percent per year and the investor acquires ... What Is a Zero Coupon Yield Curve? - Smart Capital Mind The price of a bond at any particular time depends on the market conditions, including the expectations of the market in respect of the future movements in interest rates. The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future.

Coupon rate and yield. Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... Again, the composite rate is 7.12% through August, and then will transition to 9.62% from September to February. Here's my calculation of how this interest was determined: In this case, my calculation matches the TreasuryDirect number because no compounding has yet taken place for this I Bond. BONDS | BOND MARKET | PRICES | RATES | Markets Insider You can also use the search tool to find the right bond yield and bond rates. Get all the information on the bond market. Find the latest bond prices and news. ... The coupon shows the interest ... › bootstrapping-yield-curveBootstrapping | How to Construct a Zero Coupon Yield Curve in ... Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ... US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,686 datasets) Refreshed a day ago, on 12 Aug 2022 Frequency daily Description These yield curves are...

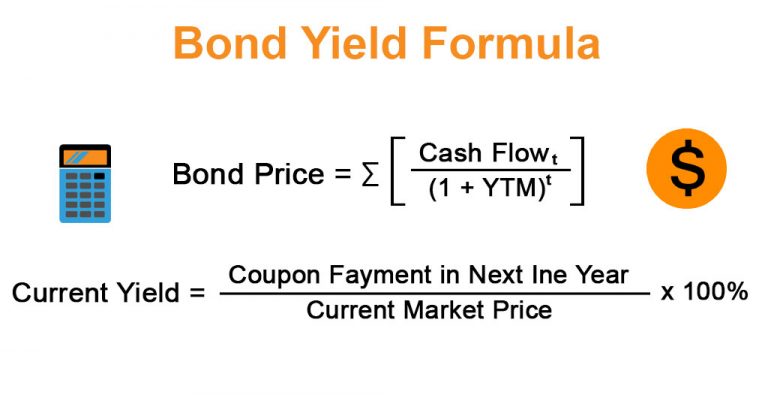

Understanding Bond Yield and Return | FINRA.org Coupon yield, also known as the coupon rate, is the annual interest rate established when the bond is issued that does not change during the lifespan of the bond. Current yield is the bond's coupon yield divided by its current market price. If the current market price changes, the current yield will also change. 10-year government bond yield by country 2022 | Statista Of the major developed economies, Australia had the highest yield on 10-year government bonds at this time with 3.31 percent, while Japan had the lowest at 0.19 percent. Yield on 10-year government... The Fed - Commercial Paper Rates and Outstanding Summary - Federal Reserve Data as of August 9, 2022 Posted August 10, 2022. The commercial paper release will usually be posted daily at 1:00 p.m. However, the Federal Reserve Board makes no guarantee regarding the timing of the daily posting. This policy is subject to change at any time without notice. Preferred Stock - YTC Calculator Calculate Yield to Call : Click the Year to select the Call Date, enter coupon call and latest price then Calculate : Call Date: * Coupon Rate (%): * Call Price ($): * Latest Price ($): * Yield to Call: %

Investor Class Auction Allotments | U.S. Department of the Treasury Data released at 3:00 PM Please see future release dates below Each table provides the following data: issue date, coupon or auction high rate, security type, cusip, maturity date, total issue amount and various designated investor class categories. Recent Data Coupon Auctions - Data from October 2009-present This table provides investor class allotments for marketable Treasury coupon ... Are Bonds a Good Investment When Interest Rates Are High? - Yahoo! Thus, bond yield is calculated as: Bond yield = Annual coupon payment / Bond price Hence, if bond prices change, so do bond rates, and thus, yields. For example, suppose you have a $500 bond with... Investors are piling into high-yield bonds. What to know before adding ... Coupon rate 'spread' is slightly smaller than usual When assessing high-yield bonds, advisors may compare the "spread" in coupon rates between a junk bond and a less risky asset, such as U.S. Treasurys. Generally, the wider the spread, the more attractive high-yield bonds become. U.S. Treasury Bond Overview - CME Group Discover a streamlined approach to trading interest rate markets with Micro Treasury Yield futures, contracts based directly on yields of the most recently auctioned Treasury securities at key tenor points across the curve. ... Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections ...

Suppose that you own a bond with a coupon rate of 8% and currently ... What is the current yield? (Round to the nearest tenth. Suppose that you own a bond with a coupon rate of 8% and currently selling at a premium of 101.75. What is the current yield? (Round to the nearest tenth percent) A) 7.9% B) 9.1% C) 8.5% D) 8.9%. Post Views: 1. Categories Questions.

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Coupon yield is the annual interest rate established when the bond is issued. It's the same as the coupon rate and is the amount of income you collect on a bond, expressed as a percentage of your original investment. If you buy a bond for $1,000 and receive $45 in annual interest payments, your coupon yield is 4.5 percent.

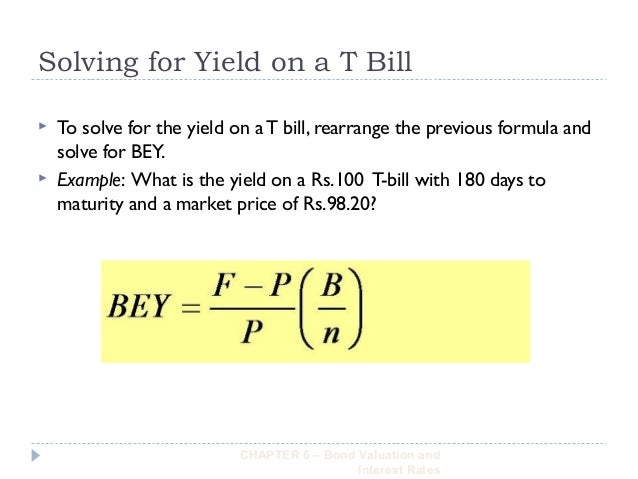

91 Day T Bill Treasury Rate - Bankrate The difference between the discounted price and the face value determines the yield. The yield on 91-day Treasury bills is the average discount rate. How it's used: The rate is used as an index for...

China Government Bonds - Yields Curve The China 10Y Government Bond has a 2.737% yield. 10 Years vs 2 Years bond spread is 55.2 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.70% (last modification in January 2022). The China credit rating is A+, according to Standard & Poor's agency.

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.289% yield. 10 Years vs 2 Years bond spread is 77.3 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.40% (last modification in August 2022). The India credit rating is BBB-, according to Standard & Poor's agency.

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ Using the 10 year yield at the 7 year mark assumes a flat yield curve. For an example of this method breaking down, see the constant maturity series for 1/02/2013 - the 10 year prevailing yield was 1.86%, but the 7 year yield was 1.25%.

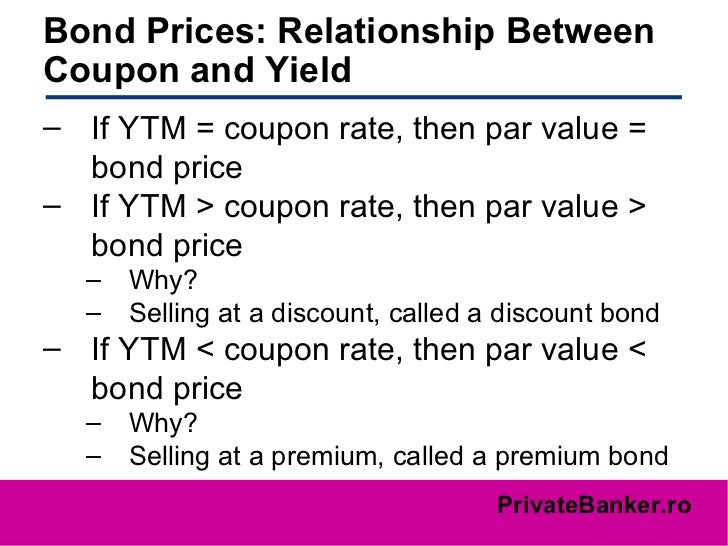

› what-is-the-coupon-rate-of-aWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · Coupon Rate vs. Yield . In contrast to the bond’s coupon rate, which is a stated interest rate based on the bond’s par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond.

› coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) Difference Between Coupon and Yield. Coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held till ...

Mexico Government Bonds - Yields Curve The Mexico 10Y Government Bond has a 8.750% yield. Central Bank Rate is 8.50% (last modification in August 2022). The Mexico credit rating is BBB, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 156.24 and implied probability of default is 2.60%.

Weighted Average Cost of Capital (WACC) Definition - Investopedia If investors expected a rate of return of 10% in order to purchase shares, the firm's cost of capital would be the same as its cost of equity: 10%. The same would be true if the company only used...

Bonds - MunicipalBonds.com Default Rates of Municipal Bonds; Taxable-Equivalent Yield; Tax-Exemption from State Income Taxes; How to Look at a Bond for Sale; Understanding Accrued Interest; The Basics on Callable Bonds and Yield-to-Call; Yield Curve - Should you buy short-term, medium-term or long-term bonds; Bond Ladders: A Basic Bond Investing Strategy; Why Do Bonds ...

Indonesia Government Bonds - Yields Curve The Indonesia 10Y Government Bond has a 6.971% yield. Central Bank Rate is 3.50% (last modification in February 2021). The Indonesia credit rating is BBB, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 97.19 and implied probability of default is 1.62%.

Investors are piling into junk bonds. What to know before buying Coupon rate 'spread' is slightly smaller than usual When assessing high-yield bonds, advisors may compare the "spread" in coupon rates between a junk bond and a less risky asset, such as U.S....

en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia Example. The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows.

ICE BofA US High Yield Index Effective Yield (BAMLH0A0HYM2EY) View data of the effective yield of an index of non-investment grade publically issued corporate debt in the U.S. ... of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $100 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets ...

Post a Comment for "40 coupon rate and yield"