42 zero coupon bonds advantages

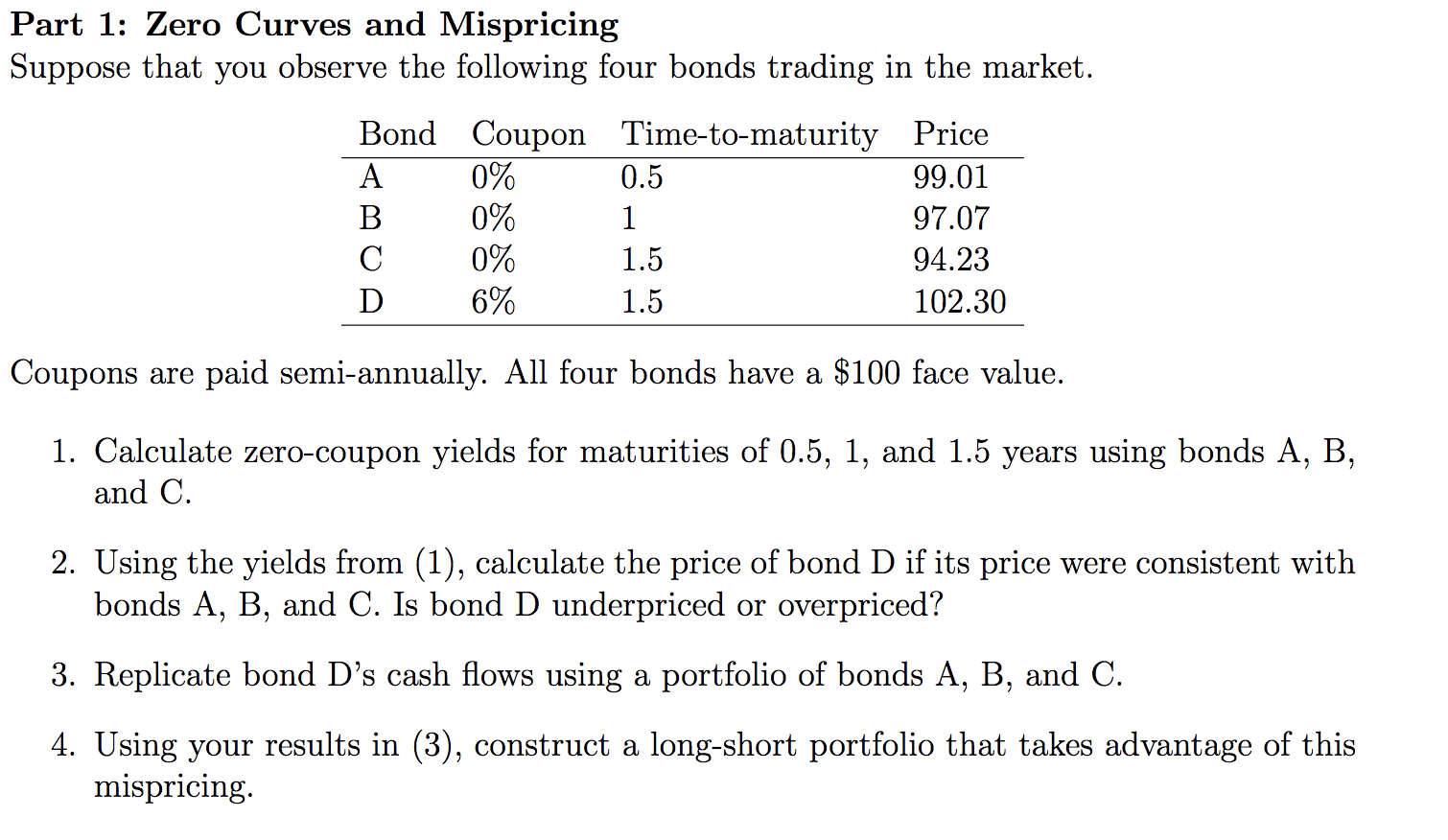

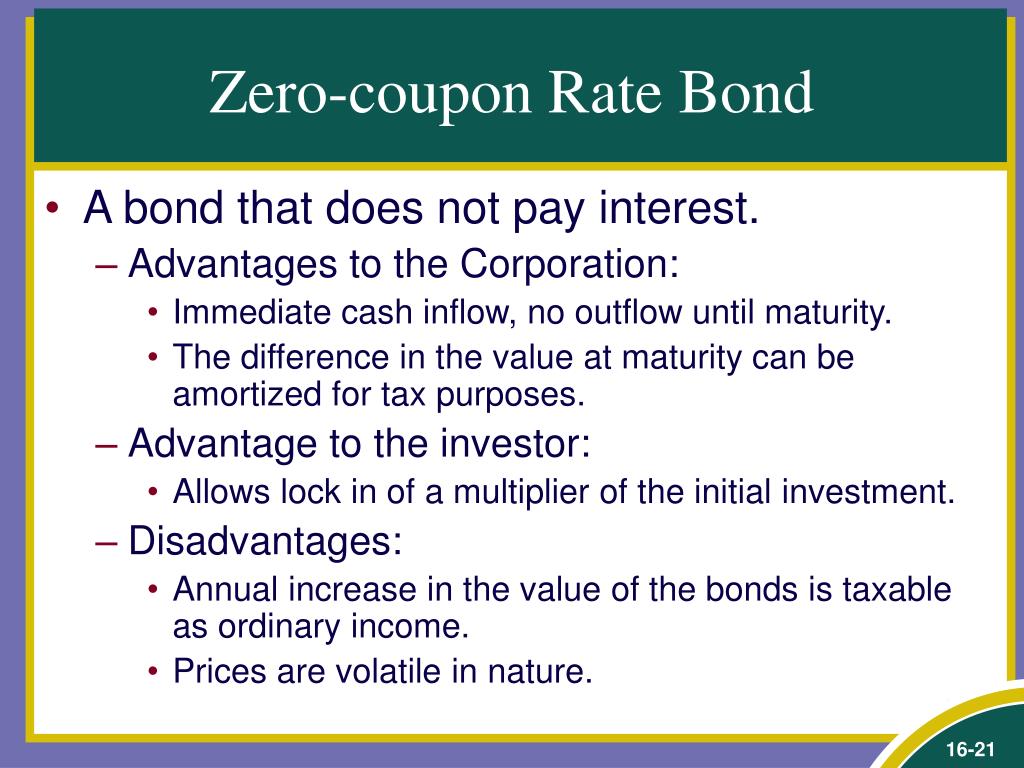

What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival. › what-are-bonds-and-howWhat Are Bonds and How Do They Work? - The Balance Jul 03, 2022 · Zero-coupon bonds: Bonds that do not pay interest during the life of the bonds. Instead, investors buy zero-coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond matures. Convertible bonds: Can be converted into a different security—typically shares of the same company's common ...

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia The municipal zero-coupon bonds can help you save tax on the interest income. Advantages of Zero-Coupon Bonds Meet Long-term Goals Zero-Coupon Bonds don't offer regular interest. Instead, the earned interest is accumulated and paid at the maturity. It thus helps create funds that can help meet your long-term goals. Fixed Returns

Zero coupon bonds advantages

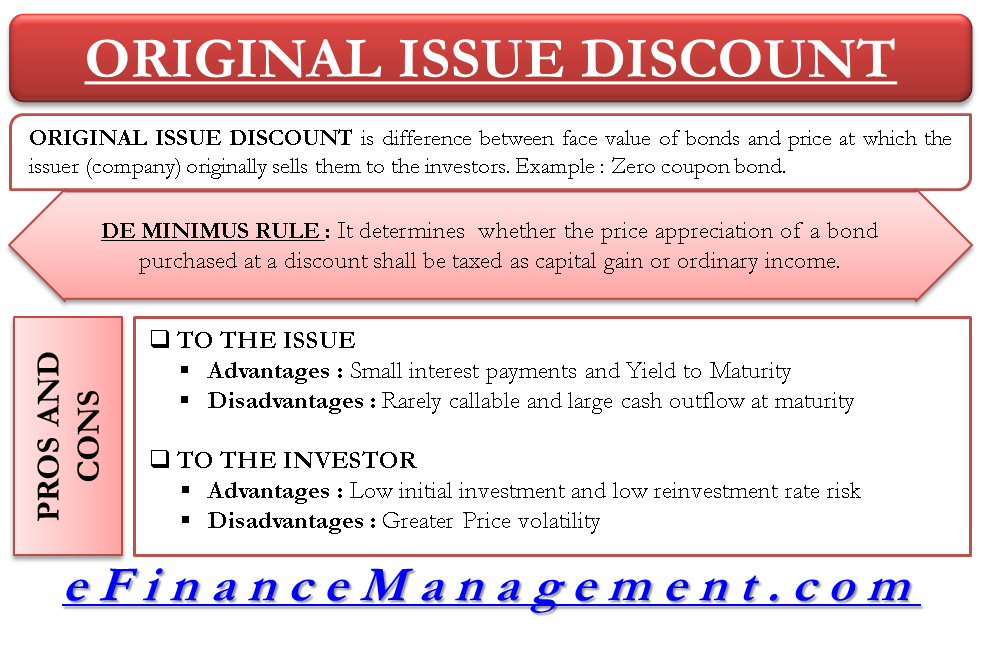

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond? Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity … Zero coupon bonds what are the advantages and - Course Hero "Low-coupon bonds and zero-coupon bonds arelong-term debt securities that are issued at a deep discount from par value. Investors aretaxed annually on the amount of interest earned, eventhough much or all of the interestwill not be received until maturity. The amount of interest taxed is the amortized dis-count.

Zero coupon bonds advantages. Zero-Coupon Bond - an overview | ScienceDirect Topics In the US market zero-coupon bonds or "zeros" were first issued in 1981 and initially offered tax advantages for investors, who avoided the income tax charge associated with coupon bonds. 6 However the tax authorities in the US implemented legislation that treated the capital gain on zeros as income, thus wiping out the tax advantage. The ... PDF Compounding advantages of zero coupon municipal bonds and zero coupon ... Zero coupon convertibles are another zero coupon structure (could be taxable as well as tax exempt) that makes a great deal of sense. This type of bond is a combination of a zero coupon bond and a convertible bond. It is issued as a zero coupon bond that pays no interest until a specified date, when it converts to a coupon-paying bond with a ... › zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., …

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N'). › createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more. What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in …

Invest in Zero Coupon Bond at Yubi | Learn All About It Advantages of Zero-Coupon Bonds Zero coupon bonds assure a fixed amount of money on maturity. They are a reliable & secure source of fixed returns for investors and an excellent choice for portfolio diversification. A zero coupon bond is immune to short-term market ups & downs. They do not offer any fixed income based on an interest rate. Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the … Zero coupon bonds what are the advantages and - Course Hero ANSWER: From the perspective of the issuing firm, low or zero coupon bonds have the advantage of requiring low or no cash outflow during the life of the bond. The issuing firm is allowed to deduct the amortized discount as interest expense for federal income tax purposes, which adds to the firm's cash flow. What is a zero-coupon bond? What are the advantages and risks? Answer (1 of 2): A zero coupon bond is a bond that pays no cash interest until maturity. All the interest accrues and is paid with the final principal payment. An advantage is that the rate of return on your investment is locked in when you buy it. You're not subject to reinvestment risk, or the ...

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

What Are Bonds and How Do They Work? - The Balance Jul 03, 2022 · Zero-coupon bonds: Bonds that do not pay interest during the life of the bonds. Instead, investors buy zero-coupon bonds at a deep discount from their face value, which is …

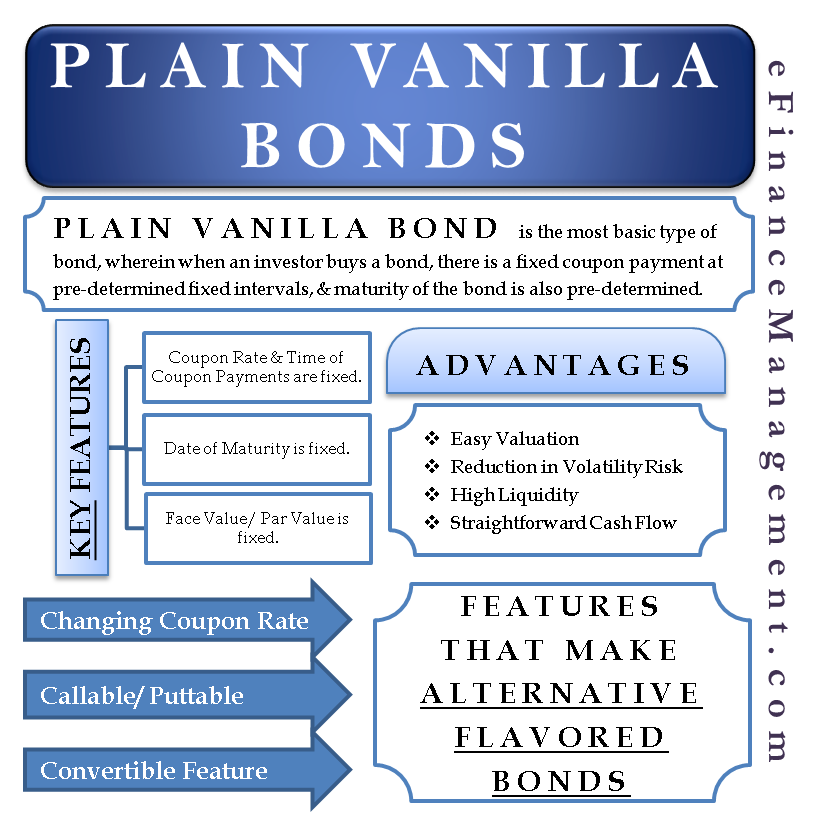

Zero-Coupon Bond Definition - Investopedia Regular bonds, which are also called coupon bonds, pay interest over the life of the bond and also repay the principal at maturity. A zero-coupon bond does not pay interest but instead trades at a...

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Original Issue Discount (OID): Formula, Uses, and Examples - Investopedia May 29, 2021 · Original Issue Discount - OID: An original issue discount (OID) is the discount from par value at the time a bond or other debt instrument is issued; it is the difference …

Corporate Bonds: Advantages and Disadvantages - Investopedia Jan 31, 2022 · Bonds that have a zero-coupon rate do not make any interest payments. Instead, governments, government agencies, and companies issue bonds with zero-coupon rates at a …

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at …

Tax Advantages of Series I Savings Bonds - The Balance May 29, 2022 · Using Series I Bonds to Pay for Education Expenses . You won't pay any tax on the interest income you earn from your Series I savings bonds if you use them to pay for …

› articles › investingCorporate Bonds: Advantages and Disadvantages - Investopedia Jan 31, 2022 · Bonds that have a zero-coupon rate do not make any interest payments. Instead, governments, government agencies, and companies issue bonds with zero-coupon rates at a discount to their par value.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them...

mbacasestudyanswers.com送料込 HEBU 2012- JAPAN アルファ ジュリエッタ フロアマット ライトブラック ロメオ 割引価格... フロアマット 2012- ライトブラック HEBU アルファ ロメオ ジュリエッタ JAPAN 割引価格 送料込 でトータル トヨタ GF-は98.08 - 95.12 - 01.02 サンデーメカニック アルファロメオ ジュリエッタ 2012年モデルの価格・グレード一覧 アルファロメオ ジュリエッタ 2012年モデルの価格・グレード一覧 楽天市場 ...

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Advantages of Zero-Coupon Bonds. It is important to understand the advantages of a Zero Coupon bond before opting for this investment. The advantages are mentioned below: No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon ...

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child's education, marriage, post-retirement goals, etc.

Zero-Coupon Bonds: Pros and Cons Some of the advantages of these bonds have been mentioned below: Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

Advantages and Risks of Zero Coupon Bonds - India Dictionary What is a zero coupon bond example? A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills. are an example of a zero-coupon bond. If the bond's stated interest rate is greater than those anticipated by the present bond ...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates.

Zero coupon bonds what are the advantages and - Course Hero "Low-coupon bonds and zero-coupon bonds arelong-term debt securities that are issued at a deep discount from par value. Investors aretaxed annually on the amount of interest earned, eventhough much or all of the interestwill not be received until maturity. The amount of interest taxed is the amortized dis-count.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity …

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

Post a Comment for "42 zero coupon bonds advantages"