45 formula for coupon rate

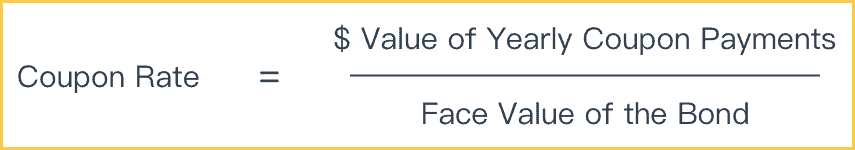

› coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula; Examples of Coupon Rate Formula (With Excel Template) Coupon Rate Formula Calculator; Coupon Rate Formula. Coupon Rate is the interest rate that is paid on a bond/fixed income security. It is stated as a percentage of the face value of the bond when the bond is issued and continues to be the same until it reaches maturity. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

› annualized-rate-of-return-formulaAnnualized Rate of Return Formula | Calculator | Example ... Let us take an example of an investor who purchased a coupon paying a $1,000 bond for $990 on January 1, 2005. The bond paid coupon at the rate of 6% per annum for the next 10 years until its maturity on December 31, 2014. Calculate the annualized rate of return earned by the investor from the bond investment.

Formula for coupon rate

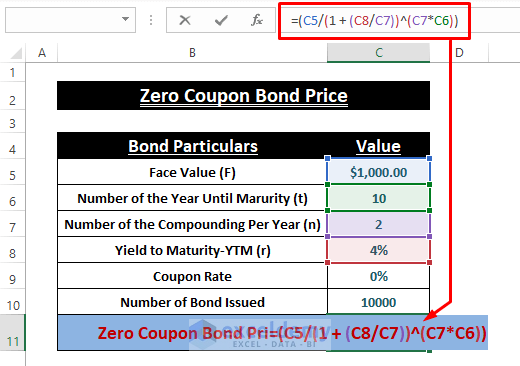

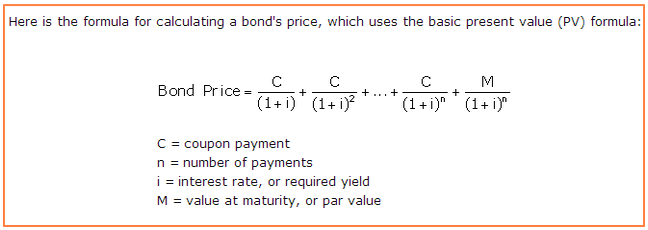

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ... corporatefinanceinstitute.com › coupon-rateCoupon Rate - Learn How Coupon Rate Affects Bond Pricing Mar 04, 2022 · Formula for Calculating the Coupon Rate. Where: C = Coupon rate. i = Annualized interest. P = Par value, or principal amount, of the bond. Download the Free Template. Enter your name and email in the form below and download the free template now! corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and; n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. In reality, zero-coupon ...

Formula for coupon rate. › coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) The coupon Rate Formula is used to calculate the coupon rate of the bond, and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments by the par value of the bonds and multiplying the resultant with the 100. corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and; n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. In reality, zero-coupon ... corporatefinanceinstitute.com › coupon-rateCoupon Rate - Learn How Coupon Rate Affects Bond Pricing Mar 04, 2022 · Formula for Calculating the Coupon Rate. Where: C = Coupon rate. i = Annualized interest. P = Par value, or principal amount, of the bond. Download the Free Template. Enter your name and email in the form below and download the free template now! › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ...

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "45 formula for coupon rate"