41 perpetual zero coupon bond

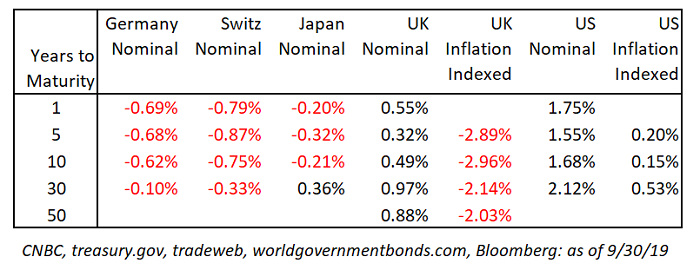

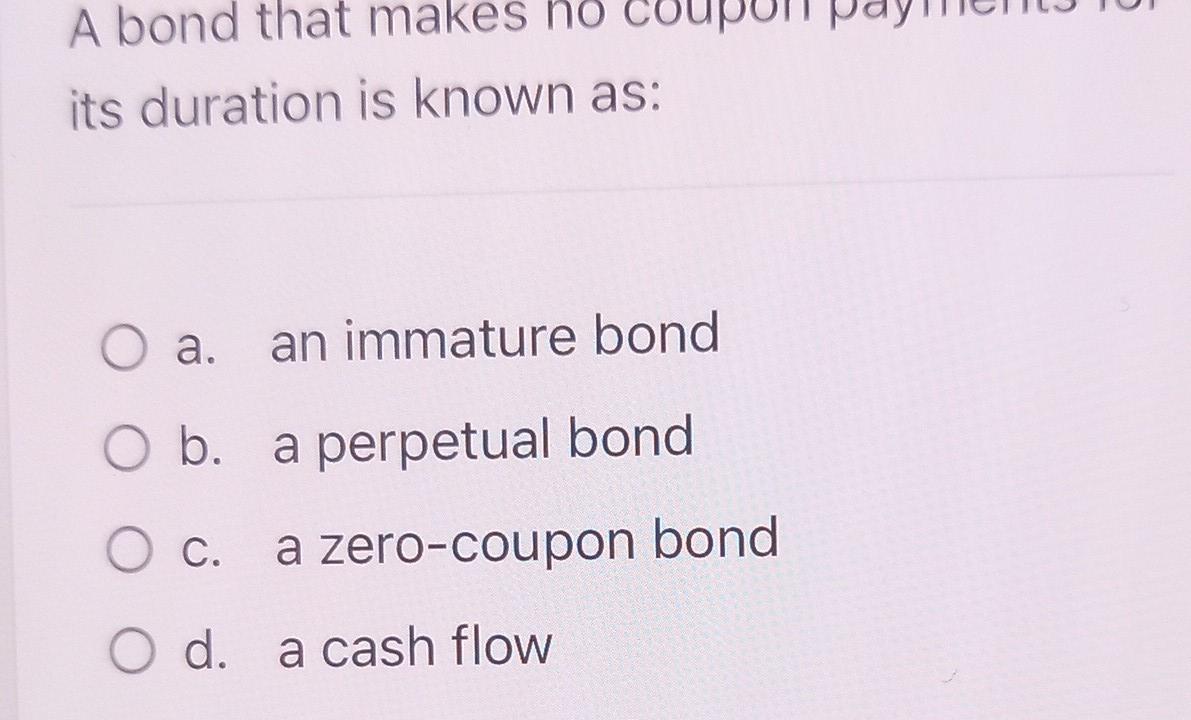

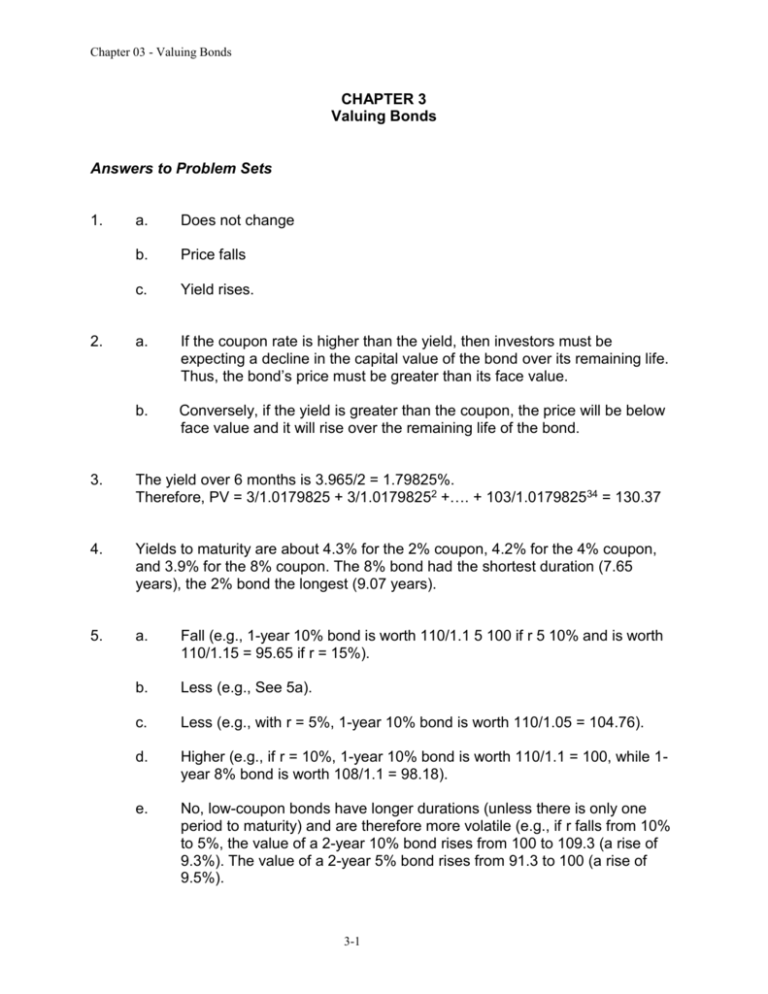

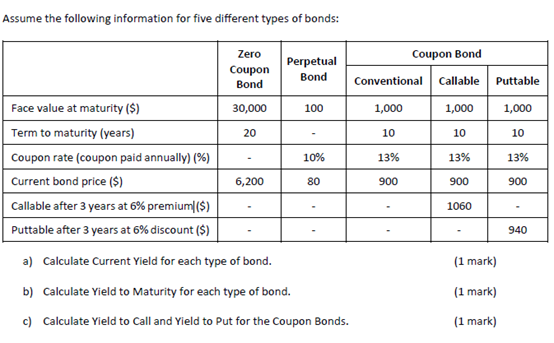

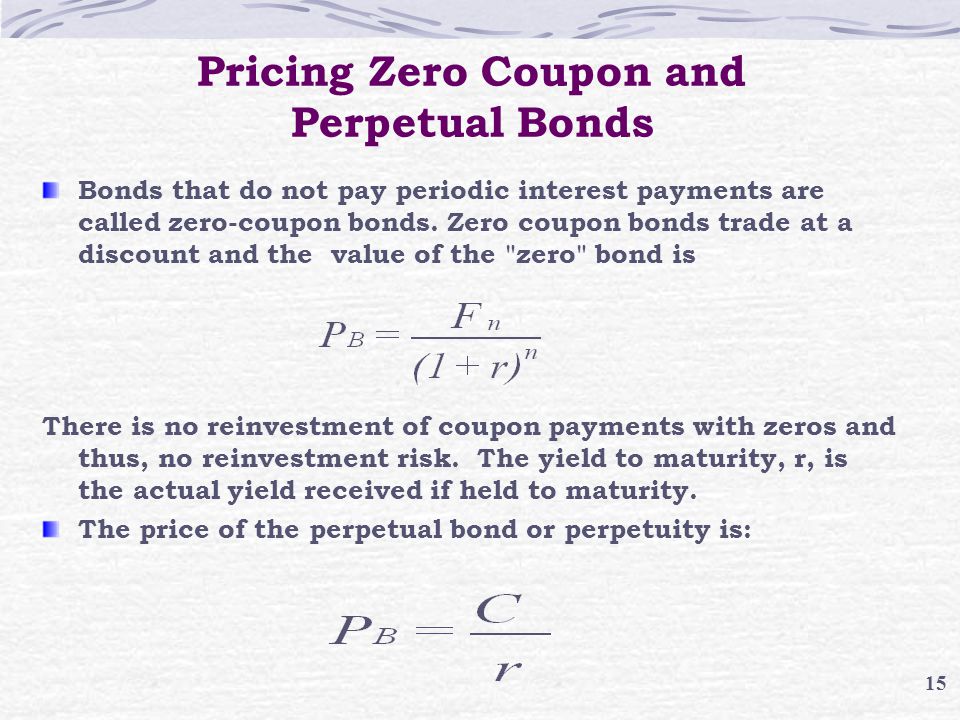

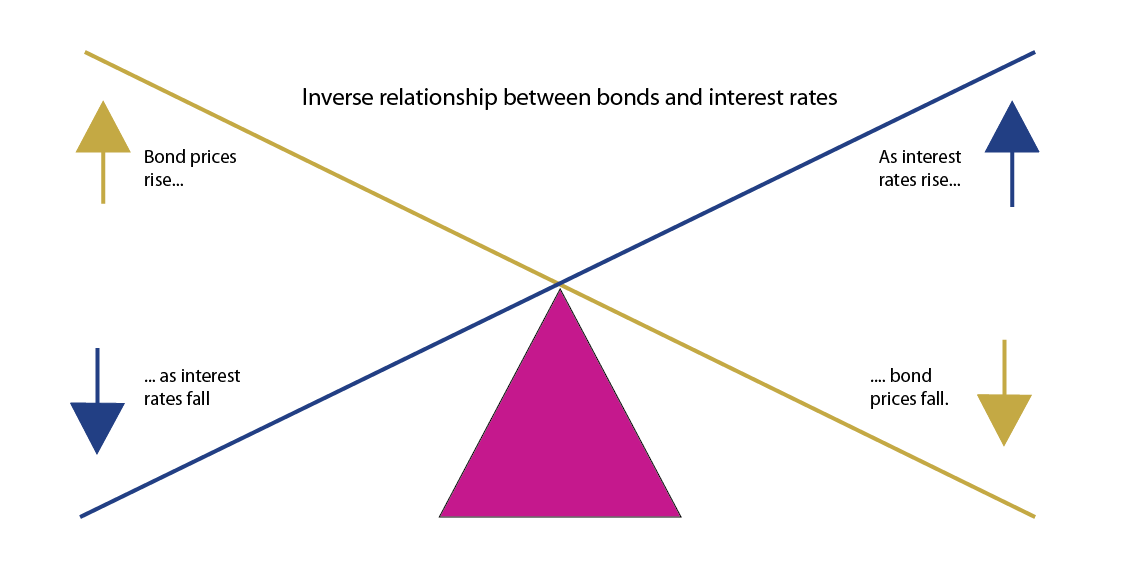

Bond duration - Wikipedia The zero-coupon bond will have the highest sensitivity, changing at a rate of 9.76% per 100bp change in yield. This means that if yields go up from 5% to 5.01% (a rise of 1bp) the price should fall by roughly 0.0976% or a change in price from $61.0271 per $100 notional to roughly $60.968. Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

Buffett: How inflation swindles the equity investor (Fortune ... Jun 12, 2011 · Stocks are perpetual. ... long-term bond with a 12% coupon had existed, it would have sold far above par. ... If zero real investment returns diverted a bit greater portion of the national output ...

Perpetual zero coupon bond

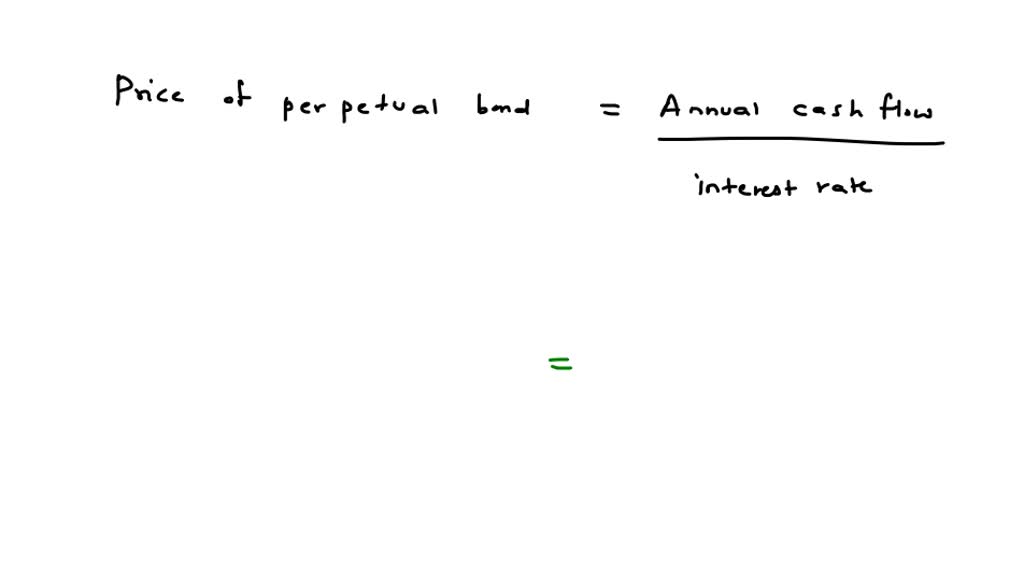

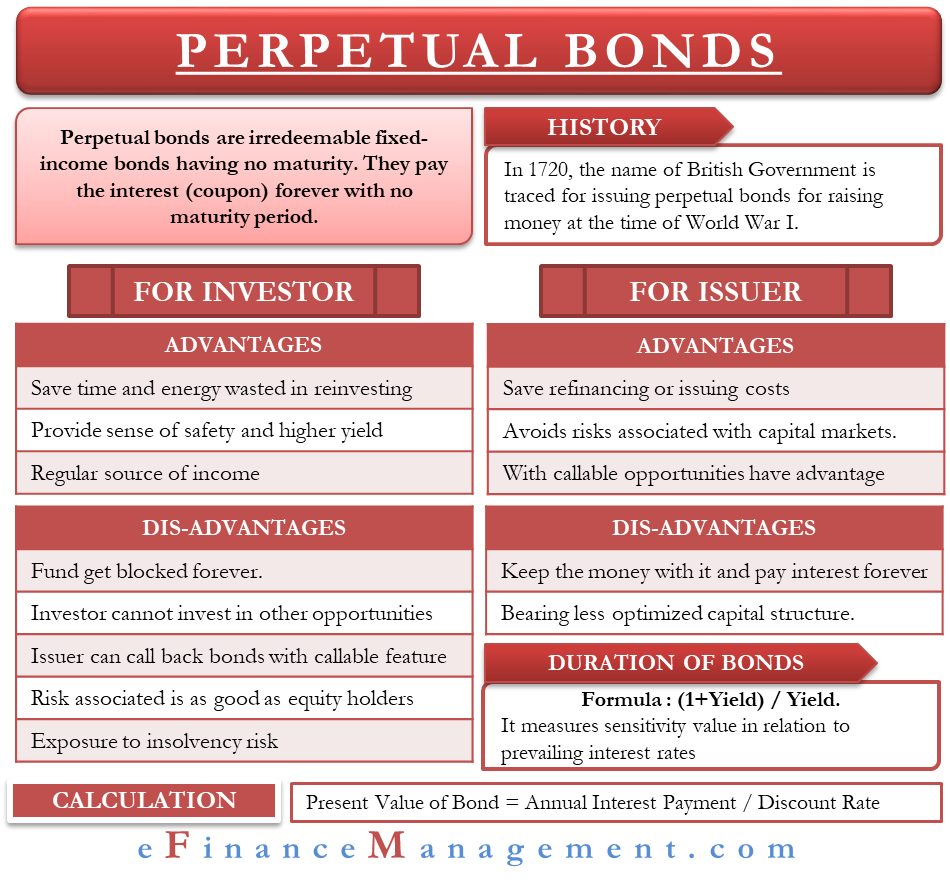

Perpetual Bond: Definition, Example, Formula To Calculate Value Mar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ... Black–Scholes model - Wikipedia See Bond option § Valuation. Interest - rate curve. In practice, interest rates are not constant—they vary by tenor (coupon frequency), giving an interest rate curve which may be interpolated to pick an appropriate rate to use in the Black–Scholes formula. Another consideration is that interest rates vary over time. Outlook – free personal email and calendar from Microsoft Expand your Outlook. We've developed a suite of premium Outlook features for people with advanced email and calendar needs. A Microsoft 365 subscription offers an ad-free interface, custom domains, enhanced security options, the full desktop version of Office, and 1 TB of cloud storage.

Perpetual zero coupon bond. How to Invest in Bonds | The Motley Fool Nov 06, 2022 · For example, you might buy a 10-year, $10,000 bond paying 3% interest. In exchange, your town will promise to pay you interest on that $10,000 every six months and then return your $10,000 after ... Outlook – free personal email and calendar from Microsoft Expand your Outlook. We've developed a suite of premium Outlook features for people with advanced email and calendar needs. A Microsoft 365 subscription offers an ad-free interface, custom domains, enhanced security options, the full desktop version of Office, and 1 TB of cloud storage. Black–Scholes model - Wikipedia See Bond option § Valuation. Interest - rate curve. In practice, interest rates are not constant—they vary by tenor (coupon frequency), giving an interest rate curve which may be interpolated to pick an appropriate rate to use in the Black–Scholes formula. Another consideration is that interest rates vary over time. Perpetual Bond: Definition, Example, Formula To Calculate Value Mar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ...

Post a Comment for "41 perpetual zero coupon bond"